Who We Are

We are united by our vision for the future, where every neighbourhood offers democratic access to nature; where biodiversity is a core stakeholder; where communities thrive and prosper; and where our most vulnerable individuals are treated with dignity and respect.

We are passionate and committed to creating tangible results. We work hard, indeed very hard, but we enjoy each others’ curiosity, care for this world, and drive to accomplish what we have all set out to do.

Let Me Explain…

Building scalable investment instruments that target institutional and private capital is not easy. Building these instruments in order to allocate funds towards nature & biodiversity, climate resilience, and homelessness is that much harder. Building instruments that are innovative because they ensure fair market returns and community ownership and governance of financed assets in perpetuity – well, that’s really hard!

This is why the team at Ombrello Solutions is solid. Every individual brings deep expertise in their area of work. It is rare to see a group that possesses corporate finance, structured debt, real estate, impact investing and nature based capital experience; balanced with conservation finance, affordable housing and community engagement. It is even rarer to have that group supported by an excellent advisory circle with stellar integrity, knowledge and network.

Finally, Ombrello Solutions is logistically sound as its operations are handled with professionalism and care, ensuring that everyone can focus on their respective building components, and have fun in the process.

Core Members

Anastasia Mourogova MillinFounder, DanSa Capital Innovation & Ombrello Solutions

In October 2022 Anastasia founded DanSa Capital Innovation and Ombrello Solutions, with a goal to build systemic investment instruments that transition institutional and private capital at scale towards key societal and environmental challenges. Anastasia Mourogova Millin brings 21 years of corporate banking experience, strategically supported by her in-depth knowledge of the commercial real estate sector. Anastasia most notably helped launch the first Canadian Schedule A impact bank – Vancity Community Investment Bank, and under that mandate she oversaw a $1.3-billion existing real estate portfolio as well as brought in $250-million in new loans to B Corps, social enterprises and not for profits. Subsequently, Anastasia – in her role as global director of Capital and Investments at Dark Matter Labs – focused on building new markets for a portfolio of civic infrastructure, including nature based solutions such as soil and biodiversity, in order to re-imagine the existing systems of capital formation, deployment and value aggregation.

Brittany ScottDirector of Operations

Brittany Scott is a sophisticated project manager with a decade of experience developing and leading complex initiatives. Known for her outstanding communication and leadership skills, Brittany approaches every project with energy, empathy, and integrity—qualities that are essential in driving forward our mission. Her background in developing and implementing organizational systems ensures the effective coordination of both our strategic efforts and day-to-day operations. Brittany holds a Bachelor of Arts with Honors and Distinction in Psychology and a Master’s degree in Child Studies, equipping her with a nuanced understanding of human behavior and societal needs. This perspective informs her holistic approach to our initiatives and the products we are building.

Jean-François ObregónCivic Infrastructure Bond, Head of Research and Financial Analysis

Jean-François Obregón is a Research Fellow at the Ivey Business School at Western University, where he focuses on improving the adoption of regenerative agriculture in Canada. He is the Principal at The Urban Hulk, a blog and consultancy focussed on socially responsible investment research and urban planning through which he is currently working with Ombrello Solutions and DanSa Capital Innovation.

Jean-François holds a Master of Planning in Urban Development from Toronto Metropolitan University, where his major research paper “The Time Is Ripe: New Financial Tools For The City Of Toronto’s Parkland Dedication Rate” detailed 20+ financial instruments that can be used to finance parkland and green space acquisition. Jean-François worked for 6+ years at Sustainalytics, a rating agency focussed on ESG risks, where finished as Lead Analyst, Financials and Real Estate. He is the lead author of the recently released “Advancing Regenerative Agriculture in Canada: Barriers, Enablers and Recommendations”.

Rifa AliCivic Infrastructure Bond, Research and Financial Analysis

Rifa Ali is a researcher whose work centers on aligning capital with community outcomes across parks and nature-based infrastructure. She is a Master of Urban Planning candidate at Toronto Metropolitan University (expected May 2026). She integrates finance, planning, and GIS to deliver decision-support tools, including pro formas, cost–benefit and outcomes frameworks, and implementation pathways, that inform the design and execution of civic-purpose investments.

Her recent work spans green infrastructure performance and lifecycle costing, housing economics and policy analysis, and transit accessibility modelling to guide equitable, high-impact investment. Rifa brings cross-sector experience, public (City of Toronto City Planning), private (Perennial Innovation), and non-profit/community (Jane & Finch Centre), and contributes applied research at TMU’s Centre for Urban Research & Land Development and DiverCity Lab.

At Ombrello Solutions, her deliverables include GIS mapping and analytics for park typologies and service areas; a structured toolkit and dataset of nature-based interventions; and financial/fiscal models to compare options and build investment cases for parks and green infrastructure.

Advisory Circle

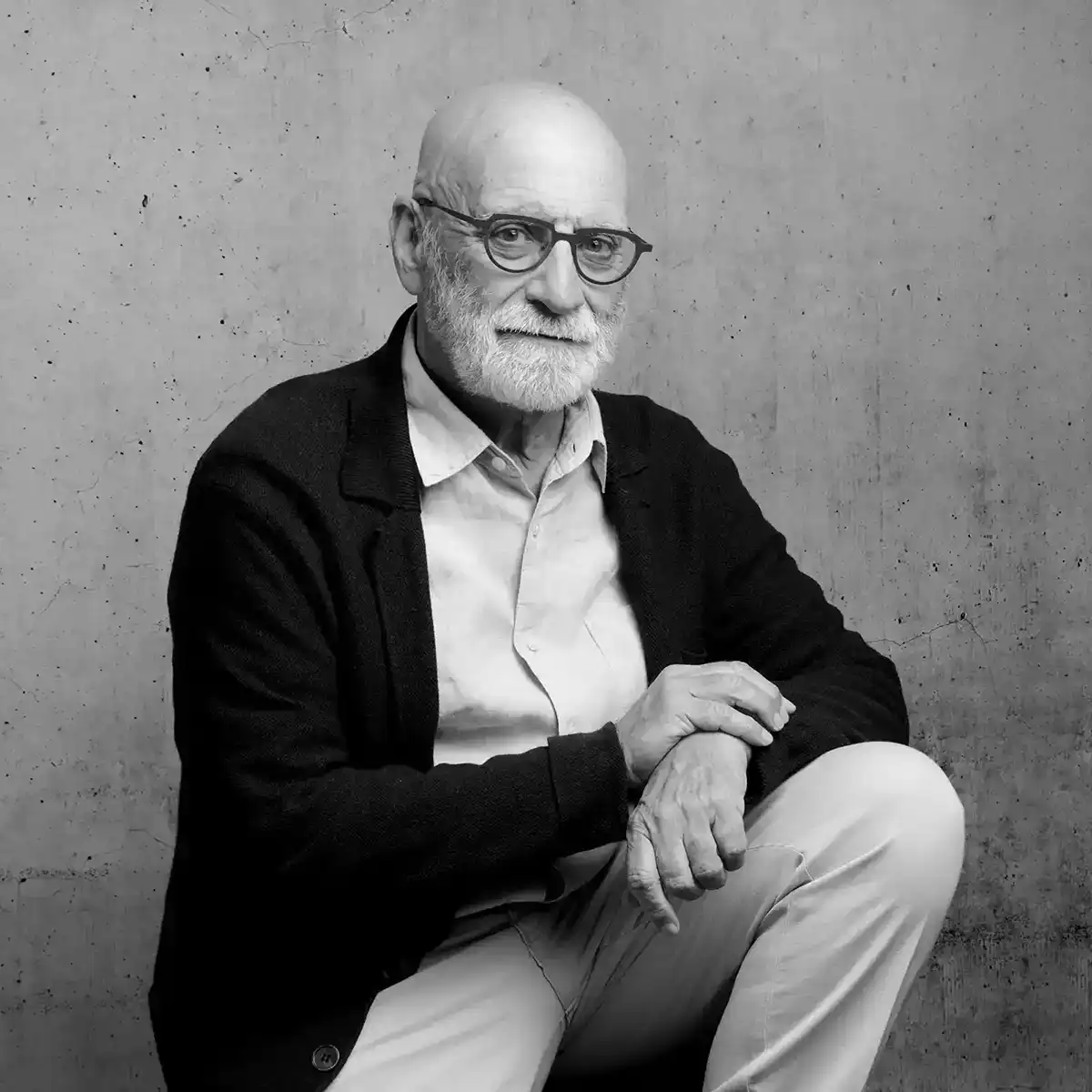

Larry WatersWaters & Co

Larry Waters worked at Canadian Imperial Bank of Commerce for forty-three years. When he retired in 2011, he was responsible for CIBC’s relationships with many of its most sophisticated property company clients. He has designed and arranged financing solutions for many landmark projects including:

- The Montréal World Trade Centre and Intercontinental Hotel mixed use project

- Bell Canada’s head office on Ile des Soeurs – Montréal

- Quartier Dix30 – Brossard,

- Aura condominium project in Toronto

- EDC Head Office, Ottawa

In addition to his 30 years experience in real estate banking, he held various other positions in commercial and corporate banking. These posts included responsibility for Commercial Banking in Eastern and Northern Ontario.

He has been a member of:

- Concordia University’s real estate planning committee

- Vice-chair of the board of governors at John Abbott College

- Chairman of the Advisory Council on Neurosciences, Ottawa Neurological Institute

- A director of the Ottawa General Hospital Foundation.

Jeremy GuthTrustee, Woodcock Foundation

Jeremy is Trustee of the Woodcock Foundation and director of the foundation’s large landscape conservation program. The program has been focused on the protection of core and corridor areas within the Yellowstone to Yukon region, which offers one of the world’s best opportunities to conserve a landscape of a sufficient scale for the full range of ecological processes and challenges such as migration and adaptation to climate change. More recently, it has expanded to include wildlife mitigation planning in rapidly developing regions internationally, where pre-construction connectivity planning efforts can be highly impactful and cost-effective. Jeremy is the co-founder of the ARC International Wildlife Crossing Infrastructure Design Competition (completed: January, 2011) and founding partner of the ARC Solutions Partnership. The competition’s achievement was to engage the most innovative international, interdisciplinary design teams to create the next generation of wildlife crossing infrastructure for North America’s roadways. The partnership continues to support the study, design and construction of wildlife crossing structures throughout North America. In 2018, Jeremy and the Woodcock Foundation commissioned Nature United to produce A Blueprint for Action: Conservation Finance to Support Canada’s Target 1 , which was the first survey of the tools and solutions Canada will need to finance its land protection commitments to the Convention on Biological Diversity (CBD).

Alison Chave

Alison is a leader in green and sustainable (ESG) finance, certified by CCBI GSP (a recognized program for sustainable finance professionals) and has passed all exams leading to an Exempt Market Dealer Designation. This provides her with deep knowledge of private investment opportunities through an environmental and social lens. Currently serving as an independent mortgage broker and consultant, Alison brings her extensive expertise to help clients navigate complex financing landscapes.

She previously held the position of Canadian Head of Debt Capital Markets at JLL, structuring innovative financial solutions for commercial clients. As Chief Risk Officer at Otéra Capital, Alison spearheaded the integration of advanced risk management strategies, including the adoption of data-driven loan structuring methods that improved portfolio resilience and transparency. At Desjardins, she was involved in public-private partnership financing (including civic infrastructure) and structured debentures in excess of $600 million for building schools in Ontario. With more than thirty years in the field, Alison has underwritten, approved, and brokered over CAN $6 billion in financing, steadily contributing through consistent leadership and practical achievements.

Beyond her professional achievements, Alison is deeply committed to community service. She has volunteered with organizations supporting homeless women and regularly contributes to her local newspaper, raising awareness on social issues. Her previous board involvement with groups such as Mères avec Pouvoir, Terre sans Frontières, Commercial Women in Real Estate, and the Québec Order of Appraisers reflects her dedication to strengthening the sector and advocating for inclusive development.